Petro Euros vs. Petro Dollars

Iran's proposed Euro-based oil trading system

is a factor behind the threat of war on Iran

Saddam Hussein's shift to petro-euros was a reason the US attacked Iraq

related page:

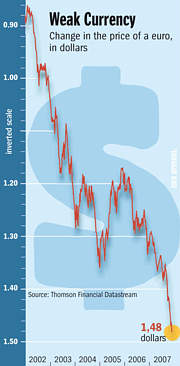

The Organization of Petroleum Exporting Countries (OPEC) is shifting away from total reliance on the dollar as an international currency - and adopting the euro as an alternative. This is probably the US government's worst nightmare, economically speaking. Saddam Hussein's biggest crime in recent years - in the minds of the US elites - is his demand to be paid in euros instead of dollars for the oil that Iraq exports (it was a wise business decision, given that the dollar has dropped and the euro is now worth $1.10, as of March 10, 2003 - $1.20 reached in December, 2003) These articles provide background and detail about the war between the dollar and the euro, which will be waged by proxy in Iraq (and Iran).

Update: as of September 2007, the euro is at $1.40 -- a substantial decline in the value of the dollar. This website does not keep track of the constant fluctuations, but the long term trend is obvious.

March 2008 - $1.50, $1.58, falling falling falling ...

What the United States gained in terms of European good will after World War II has been lost forever. And as the Euro continues to remain stronger than the dollar, there is little incentive anywhere for people here to remember.

-- Michael Ruppert

http://uk.news.yahoo.com/rtrs/20071208/tpl-uk-iran-oil-dollar-02bfc7e_1.html

Iran stops selling oil in U.S. dollars -report

Reuters - Saturday, December 8, 2007 - 10:10 am

TEHRAN (Reuters) - Iran has completely stopped selling any of its oil for U.S. dollars, an Iranian news agency reported on Saturday, citing the oil minister of the world's fourth-largest crude producer.

The ISNA news agency did not give a direct quote from Oil Minister Gholamhossein Nozari. A senior oil official last month said "nearly all" of Iran's crude oil sales were now being paid for in non-U.S. currencies.

For nearly two years, OPEC's second biggest producer has been reducing its exposure to the dollar, saying the weak U.S. currency is eroding its purchasing power.

BEHIND THE DRUMS OF WAR WITH IRAN:

NUCLEAR WEAPONS OR COMPOUND INTEREST?

Ellen Brown, November 13th, 2007

www.webofdebt.com/articles/war-with-iran.php

On October 25, 2007, the United States announced harsh new penalties on the Iranian military and its state-owned banking systems. Sanctions, bellicose rhetoric and the implicit threat of military action are goads for another war, one that critics fear is more likely to ignite a nuclear holocaust than prevent one. The question is, why is Iran considered such a serious threat? The official explanation is that it is planning to develop nuclear weapons. But the head of the UN watchdog agency IAEA says he has "no concrete evidence" of an Iranian weapons program. And even if there were one, a number of countries have tested or possess nuclear weapons outside the Nuclear Non-Proliferation Treaty, including Pakistan, North Korea, India, and probably Israel; yet we don't consider that grounds for military action. Iran would just be joining a long list of nuclear powers.

Another theory says the push for war is all about oil; but Iran supplies only 15 percent of total Persian Gulf oil exports, and its oil is already for sale. We don't need to go to war for it. We can just buy it.

A third theory says the saber-rattling is about defending the dollar. Iran is threatening to open its own oil bourse, and it is already selling about 85 percent of its oil in non-dollar currencies. Iran has broken the petrodollar stranglehold imposed in the 1970s, when OPEC entered into a covert agreement with the United States to sell oil only in U.S. dollars.

www.iht.com/articles/2007/09/13/news/econ.php

Dollar's Retreat Raises Fear of Collapse

By Carter Dougherty

The International Herald Tribune

Thursday 13 September 2007

Frankfurt - Finance ministers and central bankers have long fretted that at some point, the rest of the world would lose its willingness to finance the United States' proclivity to consume far more than it produces - and that a potentially disastrous free-fall in the dollar's value would result.

But for longer than most economists would have been willing to predict a decade ago, the world has been a willing partner in American excess - until a new and home-grown financial crisis this summer rattled confidence in the country, the world's largest economy.

On Thursday, the dollar briefly fell to another low against the euro of $1.3927, as a slow decline that has been under way for months picked up steam this past week.

http://biz.yahoo.com/ap/070917/germany_greenspan_euro.html?.v=1

Greenspan: Euro Gains As Reserve Choice

Monday September 17, 8:07 am ET

Report: Former Fed Boss Says Euro Could Replace U.S. Dollar As Favored Reserve Currency

FRANKFURT, Germany (AP) -- Former U.S. Federal Reserve chairman Alan Greenspan said it is possible that the euro could replace the U.S. dollar as the reserve currency of choice.

| Recycling Petro Dollars and the Emergence of Petro Euros |

www.museletter.com/archive/132.html

The US and Eurasia: End Game for the Industrial Era? by Richard

Heinberg

In November 2000, Iraq announced that it would cease to accept dollars for its oil, and would accept instead only euros. At the time, financial analysts suggested that Iraq would lose tens of millions of dollars in value because of this currency switch; in fact, over the following two years, Iraq made millions. Other oil-exporting nations, including Iran and Venezuela, have stated that they are contemplating a similar move. If OPEC as a whole were to switch from dollars to euros, the consequences to the US economy would be catastrophic. Investment money would flee the country, real estate values would plummet, and Americans would shortly find themselves living in Third-World conditions.

Currently, if any country wishes to obtain dollars with which to buy oil, it can do so only by selling its goods or resources to the US, taking out a loan from a US bank (or the World Bank - functionally the same thing), or trading its currency on the open market and thus devaluing it. The US is in effect importing goods and services virtually for free, its massive trade deficit representing a huge interest-free loan from the rest of the world. If the dollar were to cease being the world's reserve currency, all of that would change overnight ....

For US geostrategists, the prevention of an OPEC switch from dollars to euros must therefore seem paramount. An invasion and occupation of Iraq would effectively give the US a voting seat in OPEC while placing new American bases within hours' striking distance of Saudi Arabia, Iran, and several other key OPEC countries.

The second factor likely weighing on Bush's decision to invade Iraq is the depletion of US energy resources and the consequently increasing American dependency on oil imports. The oil production of all non-OPEC countries, taken together, probably peaked in 2002. From now on, OPEC will have ever more economic power in the world. Moreover, global oil production will probably peak within a few years. As I have discussed elsewhere, alternatives to fossil fuels have not been developed sufficiently to permit a coordinated process of substitution once oil and natural gas grow scarce. The implications - especially for major consumer nations such as the US - will eventually be ruinous.

Both problems are of overwhelming urgency. Bush's Iraq strategy is apparently an offensive one designed to enlarge the US empire, but in reality it is primarily defensive in character since its deeper purpose is to forestall an economic cataclysm.

It is the two factors of dollar hegemony and oil depletion - even more than the hubris of the neo-conservative strategists in Washington - that are prompting an overall de-emphasis of long-standing alliances with Europe, Japan, and South Korea; and the increasing deployment of US troops in the Middle East and Central Asia.

While no one is talking about it openly, top echelons in the governments of Russia, China, Britain, Germany, France, Saudi Arabia and other countries are keenly aware of these factors - hence the shifting alliances, the veto threats, and the back-room negotiations leading up to the US invasion of Iraq.

But the war, though by now inevitable, remains a highly risky gamble. Even if it ends in days or weeks with a decisive American victory, we will not know for some time whether that gamble has paid off. ....

Even in the best case, petroleum resources are limited and, as they gradually run out over the next few decades, will be unable to support the further industrialization of China or the maintenance of industrial infrastructure in Europe, Russia, Japan, Korea, or the US.

Who will rule Eurasia? In the end, no single power will be capable of doing so, because the energy-resource base will be insufficient to support a continent-wide system of transportation, communication, and control. Thus Russian geopolitical fantasies are as vain as those of the US. For the next half-century there will be just enough energy resources left to enable either a horrific and futile contest for the remaining spoils, or a heroic cooperative effort toward radical conservation and transition to a post-fossil-fuel energy regime.

The next century will see the end of global geopolitics, one way or another. If our descendants are fortunate, the ultimate outcome will be a world of modest, bioregionally organized communities living on received solar energy.

Russia`s Switch into the Euro signals Decline of

US Dollar as a Global Currency

The Global Redlining of America:

Bush Plunges U.S. into Rapid Decline

www.blackcommentator.com 16 October 2003

The previously unthinkable is now on the table. Russia, the world's second largest oil exporter, is giving serious consideration to trading its black gold in euros, a switch that would surely set dominos in motion among other oil producing nations and, ultimately, knock the dollar off its global throne.

The Dollar Has Had Its Day

Is There a Eurologist in the House?

www.counterpunch.org/tripp03082003.html

humorous article summarizing the situation

The Real Reasons for the Upcoming War With Iraq: A Macroeconomic

and Geostrategic Analysis of the Unspoken Truth

by W. Clark January 2003 (last revised 6 March) Independent Media Center

www.ratical.org/ratville/CAH/RRiraqWar.html

Although completely suppressed in the U.S. media, the answer to the Iraq enigma is simple yet shocking - it an an oil CURRENCY war. The Real Reason for this upcoming war is this administration's goal of preventing further OPEC momentum towards the euro as an oil transaction currency standard. However, in order to pre-empt OPEC, they need to gain geo-strategic control of Iraq along with its 2nd largest proven oil reserves. This lengthy essay will discuss the macroeconomics of the "petro-dollar" and the unpublicized but real threat to U.S. economic hegemony from the euro as an alternative oil transaction currency.

Bush's Deep Reasons For War on Iraq: Oil, Petrodollars, and the

OPEC Euro Question, by Peter Dale Scott, updated 2/15/2003

http://ist-socrates.berkeley.edu/~pdscott/iraq.html

By Paul Harris - YellowTimes.org Columnist (Canada) YellowTimes.org –

There are many reasons for George Bush's single-minded drive toward Baghdad. In other articles I have written for YellowTimes.org, I hinted that a not so obvious reason for the drive against Iraq is Bush's war against Europe. In fact, I have now come to believe that is the primary reason for his Iraqophenia.

Whenever a nation decides to go to war, there are plans made for who is going to win and who is going to lose; no one goes to war expecting to lose, but it isn't always the obvious target of the aggression that is the real thrust behind the war. Sometimes, it isn't a case of what you expect to win from a war, but rather a case of what you hope someone else loses; and it doesn't have to be your stated enemy who you hope will sustain the losses.

In this case, Bush's hoped-for victim is the European economy. It is robust, and is likely to become much stronger in the easily foreseeable future. Britain's entry into the European Monetary Union is inevitable; Scandinavia will join sooner rather than later. Already, even without those countries, there will be 10 new member nations in May 2004, which will swell the GDP of the E.U. to about $9.6 trillion with 450 million people as against $10.5 trillion and 280 million people in the United States. This represents a formidable competing block for the United States but the situation is significantly more complex than what is revealed just by those numbers. And much of it hinges on the future of Iraq.

I have written before, as have many others, that this upcoming war is about oil. To be sure there are other reasons, but oil is the single most impelling force. Not in the way you might expect, however. It isn't so much that there are believed to be huge untapped oil reserves in Iraq, untapped only due to outdated technology; it isn't so much an American desire to get its grubby hands on that oil; it is much more a question of whose grubby hands the Americans want to keep it out of.

What precipitated all of this was not September 11, nor a sudden realization that Saddam was still a nasty guy, nor just the change in leadership in the United States. What precipitated it was Iraq's November 6, 2000 switch to the euro as the currency for its oil transactions. At the time of the switch, it might have seemed daft that Iraq was giving up such a lot of oil revenue to make a political statement. But that political statement has been made and the steady depreciation of the dollar against the euro since then means that Iraq has derived good profits from switching its reserve and transaction currencies. The euro has gained about 17 percent against the dollar since that time, which also applies to the $10 billion held in Iraq's United Nations "oil for food" reserve fund.

So the question arises, as it did for George Bush, what happens if OPEC makes a sudden switch to euros? In a nutshell, all hell breaks loose.

At the end of World War II, an agreement was reached at the Bretton Woods Conference which pegged the value of gold at $35 per ounce and that became the international standard against which currency was measured. But in 1971, Richard Nixon took the dollar off the gold standard and ever since, the dollar has been the most important global monetary instrument, and only the United States can produce them. The dollar, now a fiat currency, is at a 16-year trade-weighted high despite record U.S. current-account deficits and the status of the U.S. as the leading debtor nation. The U.S. national debt as of April 4, 2002 was $6.021 trillion against GDP of $9 trillion.

Trade between nations has become a cycle in which the U.S. produces dollars and the rest of the world produces things that dollars can buy. Nations no longer trade to capture comparative advantage but rather to capture needed dollars to service dollar-denominated foreign debts and to accumulate dollar reserves in order to sustain the exchange value of their domestic currencies. In an effort to prevent speculative and potentially harmful attacks on their currencies, those nations' central banks must acquire and hold dollar reserves in amounts corresponding to their own currencies in circulation. This creates a built-in support for a strong dollar that in turn forces the world's central banks to acquire and hold even more dollar reserves, making the dollar stronger still.

This phenomenon is known as "dollar hegemony," which is created by the geopolitically constructed peculiarity that critical commodities, most notably oil, are denominated in dollars. Everyone accepts dollars because dollars can buy oil.

The reality is that the strength of the dollar since 1945 rests on being the international reserve currency for global oil transactions (i.e., "petro-dollar"). The U.S. prints hundreds of billions of these fiat petro-dollars, which are then used by nation states to purchase oil and energy from OPEC producers (except presently Iraq and, to some degree, Venezuela). These petro-dollars are then re-cycled from OPEC back into the U.S. via Treasury Bills or other dollar-denominated assets such as U.S. stocks, real estate, etc. The recycling of petro-dollars is the price the U.S. has extracted since 1973 from oil-producing countries for U.S. tolerance of the oil-exporting cartel.

Dollar reserves must be invested in U.S. assets which produces a capital-accounts surplus for the U.S. economy. Despite poor market performance during the past year, U.S. stock valuation is still at a 25-year high and trading at a 56 percent premium compared with emerging markets. The U.S. capital-account surplus finances the U.S. trade deficit.

Since it is the U.S. that prints the petro-dollars, they control the flow of oil. Period. When oil is denominated in dollars through U.S. state action and the dollar is the only fiat currency for trading in oil, an argument can be made that the U.S. essentially owns the world's oil for free.

So what happens if OPEC as a group decides to follow Iraq's lead and suddenly begins trading oil on the euro standard? Economic meltdown. Oil-consuming nations would have to flush dollars out of their central bank reserves and replace them with euros. The dollar would crash in value and the consequences would be those one could expect from any currency collapse and massive inflation (think of Argentina for an easy example). Foreign funds would stream out of U.S. stock markets and dollar denominated assets; there would be a run on the banks much like the 1930s; the current account deficit would become unserviceable; the budget deficit would go into default; and so on.

And that's just in the United States. Japan would be particularly hard hit because of total dependence on foreign oil and incredible sensitivity to the U.S. dollar. If Japan's economy tumbles, so does that of many other countries, especially the United States in a crescendo of dominos.

Now, this is the potential effect of a "sudden" switch to euros. A more gradual shift might be manageable but even that would change the financial and political balance of the world. Given the size of the European market, its population, its need for oil (it actually imports more oil than the U.S.), it may be rapidly approaching that the euro will become the de facto monetary standard for the world.

There are some good reasons for OPEC as a group to follow Iraq and begin to value oil in euros. There seems little doubt that they would relish the opportunity to make a political statement after years of having to kowtow to the U.S., but there are solid economic reasons as well.

The mighty dollar has reigned supreme since 1945, and in the last few years has gained even more ground with the economic dominance of the United States. By the late 1990s, more than four-fifths of all foreign exchange transactions, and half of all world exports, were denominated in dollars. In addition, U.S. currency accounts for about two thirds of all official exchange reserves. The world's dependency on U.S. dollars to pay for trade has seen countries bound to dollar reserves, which are disproportionately higher than America's share of global output.

It is important to note that the euro is not at any disadvantage versus the dollar when one compares the relative sizes of the economies involved, especially given the E.U. enlargement plans. Moreover, the E.U. has a bigger share of global trade than the U.S. and while the U.S. has a huge current account deficit, the E.U. has a more balanced external accounts position. One of the more compelling arguments for keeping oil pricing and payments in dollars has been that the U.S. remains a large importer of oil, despite being a substantial producer itself. But the EU is an even larger importer of oil and petroleum products than the U.S., and represents for OPEC a more attractive market, closer and less domineering.

The point of Bush's war against Iraq, therefore, is to secure control of those oil fields and revert their valuation to dollars, then to increase production exponentially, forcing prices to drop. Finally, the point of Bush's war is to threaten significant action against any of the oil producers who would switch to the euro.

In the long run, then, it is not really Saddam who is the target; it is the euro and, therefore, Europe. There is no way the United States will sit by idly and let those upstart Europeans take charge of their own fate, let alone of the world's finances.

Of course, all of this depends on Bush's insane plan not becoming the trigger for a Third World War, as it so readily might.

Excerpts from "The Real Reasons for the Upcoming War with Iraq: A Macroeconomic and Geostrategic Analysis of the Unspoken Truth" used with permission of the author, William R. Clark. This author owes a debt of gratitude to Mr. Clark and encourages you to read Mr. Clark's complete essay at: http://www.ratical.org/ratville/CAH/RRiraqWar.html.

[Paul Harris is self-employed as a consultant providing Canadian businesses with the tools and expertise to successfully reintegrate their sick or injured employees into the workplace. He has traveled extensively in what we arrogant North Americans refer to as "the Third World," and he believes that life is very much like a sewer: what you get out of it depends on what you put into it. Paul lives in Canada.]

Paul Harris encourages your comments: pharris@ YellowTimes.org

YellowTimes.org is an international news and opinion publication. YellowTimes.org encourages its material to be reproduced, reprinted, or broadcast provided that any such reproduction identifies the original source, http://www.YellowTimes.org. Internet web links to http://www.YellowTimes.org are appreciated.

| Syria switches to Euro for foreign reserves |

Syria switches to euro amid confrontation with US

Mon Feb 13, 2006 5:11 PM ET

DAMASCUS, Feb 13 (Reuters) - Syria has switched all of the state's foreign currency transactions to euros from dollars amid a political confrontation with the United States, the head of state-owned Commercial Bank of Syria said on Monday.

"This is a precaution. We are talking about billions of dollars. Switching to the euro will help us avoid settlement problems in the United Sates," Duraid Durgham told Reuters.

"The move is also needed to avoid complications with our correspondent banks, which have expressed a preference to deal in euro under these circumstances," he said.

Most of the government's foreign currency flows goes through the Commercial Bank, whose U.S. assets were frozen by Washington in 2004 as relations with Syria deteriorated.

The bank, which dominates the Syrian market, also stopped dealing with dollars for international private flows, such as imports, exports and letters of credit, Durgham said.

He said the switch would mean euro pricing for crude oil sales, a major foreign currency earner for Syria.

The latest official figure show Syria imported $6.7 billion goods in 2004 and exported $5.4 billion. Oil output is around 400,000 barrels per day.

In 2004, Washington imposed sanctions that prohibited certain U.S. exports to Syria, severed financial ties with the Commercial Bank of Syria, and froze the assets of Syrians believed linked to terrorism.

After the assassination of former Lebanese Prime Minister Rafik al-Hariri a year ago, the United States led foreign pressure on Syria for its alleged role in the killing.

Damascus denies involvement in the killing but faces the possibility of more sanctions if it is found uncooperative with a U.N. investigation into the killing of Hariri.

Regional financiers said the Syria managed to minimise the damage of U.S. sanctions and deal with economic uncertainty that followed the Hariri assassination, including pressure on the Syrian pound.

The government, controlled by the Baath Party for the last for 40 years, has proceeded with steps to open up the economy after decades of central planning, naming on Monday a board to head up a stock exchange under formation.

"To its credit, the government managed to keep the economic cycle going; imports, exports and tourism did not suffer a major blow. The have reacted effectively to pressure," said Joe Sarrouh, a senior executive at Fransabank in Beirut.

One economist said euro move by the Commercial Bank of Syria "looked like a kind of pre-emptive action aimed at making their foreign assets safer and preventing them from getting frozen in case of any conflict."

© Reuters 2006. All Rights Reserved.

A story title that will be repeated many times in the years to come ...

December 27, 2004

Dollar Falls to New Low Vs Euro

NEW YORK (Reuters) - The dollar fell to new lows against the euro on Monday, part of broad losses the U.S. currency suffered as traders gunned down technical targets amid thin market conditions.

Many traders and investors were on extended vacations after the Christmas holiday keeping volume relatively low and causing small orders to have exaggerated effects on prices.

"Today traders primarily went after stop-loss orders, taking advantage of thin market conditions between the Christmas holiday and the New Year and succeeding in driving the dollar lower," said Alex Beuzelin, foreign exchange analyst with Ruesch International.

"It was largely a technical move that was very consistent with the underlying fundamental concerns on the greenback," he added. Stop-losses are orders to buy or sell a currency when it hits a predetermined level. In a session rife with technically driven moves, small purchases of euros triggered stop-loss buy orders which lifted the euro zone currency to a new all-time high of $1.3640, according to Reuters data.

Bush is destroying the economy,

the Bill of Rights, and the Earth

"The dollar fell to record lows around $1.2647 per euro ... bringing its losses this year to more than 17 percent."

Dollar Plumbs New Lows Vs Euro, Reuters,

Dec 31, 2003

Jan 5, 2004 (Reuters) - "Gold futures traded above $425 an ounce for the

first time in more than 15 years in New York Monday, extending its watershed

rally on the first trading day of 2004 as investors continued to diversify

out of the beleagured dollar. Other precious metals surged as well, but

gold is considered a form of currency and is seen as a hard alternative

to the greenback. It built on last year's 20 percent gain as the dollar

hit a new low against the soaring euro and fell to its cheapest level

against the yen in three years."

"America's challenge is not just to reduce its current-account deficit to a level which foreigners are happy to finance by buying more dollar assets, but also to persuade existing foreign creditors to hang on to their vast stock of dollar assets, estimated at almost $11 trillion. A fall in the dollar sufficient to close the current-account deficit might destroy its safe-haven status. If the dollar falls by another 30%, as some predict, it would amount to the biggest default in history: not a conventional default on debt service, but default by stealth, wiping trillions off the value of foreigners' dollar assets.

"The dollar's loss of reserve-currency status would lead America's creditors to start cashing those cheques—and what an awful lot of cheques there are to cash. As that process gathered pace, the dollar could tumble further and further."

The disappearing dollar

Dec 2nd 2004

From The Economist print edition

www.economist.com/opinion/displayStory.cfm?story_id=3446249

Bush's "re-election" causes plummit in dollar

http://news.ft.com/cms/s/a67665a0-2e8d-11d9-97e3-00000e2511c8.html

Dollar falls to nine-year lows

By Steve Johnson and Kevin Morrison in London and Jennifer Hughes in New

York

Published: November 4 2004 18:19 | Last updated: November 4 2004 18:19

The dollar fell to fresh nine-year lows in trade-weighted terms on Thursday and gold prices reached a 16-year peak amid concerns over tensions in the Middle East and a renewed belief in the dollar's longer-term decline.

Traders said reports of Yassir Arafat's continuing ill-health were weighing on the dollar. “This spells trouble for the dollar since it could mean protracted US involvement in the region, not just Iraq,” said Kamal Sharma, currencies strategist at Dresdner Kleinwort Wasserstein.

Middle Eastern investors, including central banks, have been active in the market selling dollars over the past two days, according to traders. There has been speculation for some time that investors in the region would seek to diversify their largely dollar-based wealth as the greenback weakened.

“People are not just looking at simply the next few months for the dollar, they're looking more broadly at a decline over the next few years,” said Tony Norfield, global head of currency strategy at ABN Amro.

The greenback's weakness was also attributed to the re-election of President George W. Bush. Since the start of Mr Bush's first term the dollar has fallen 20.8 per cent in trade-weighted terms and observers do not expect a change in dollar policy in his second term.

“Dollar sentiment is dire at the moment,” said Derek Halpenny, senior currency economist at Bank of Tokyo-Mitsubishi. “Bush has been given an extremely strong mandate and that raises doubts about his commitment to reduce the budget deficit by half over a five-year period.”

Thursday's selling saw the dollar fall to $1.2886, within 0.4 cents of its February all-time low against the euro. It declined to an eight-year low of SFr1.1854 against the Swiss franc, a 12-year low of C$1.2034 against the Canadian dollar and to within a whisker of a six-month low against the yen.

Gold hit a 16-year high of $432.95 a troy ounce, before settling at $429.65/$430.40 in late London trade.

The dollar's decline against the euro was hastened by Jean-Claude Trichet, the president of the European Central Bank, who emphasised the risk of inflation at a press conference but declined to say that the euro's strength of the euro was hurting the eurozone.

The U.S. also faces a unique problem in that commodities such as oil and base metals are priced in U.S. dollars.

Steven DeSanctis, small-cap strategist with Prudential Equity Group said his biggest concern is that oil prices can stay high in dollar terms, as people outside the U.S. are effectively paying less.

Economies using the euro will see lower energy costs and a lift in their economies, but in the U.S. -- the world's largest consumer of oil -- companies will see profits erode.

http://uk.news.yahoo.com/031221/325/ehl5i.html

Sunday December 21, 05:53 PM

Dollar's drop becomes more ominous

By Nick Olivari

www.hindustantimes.com/news/181_490084,00020008.htm

OPEC may trade oil in euros to compensate for dollar decline

Associated Press

Caracas (Venezuela), December 10

OPEC Secretary General Alvaro Silva said the organisation is considering trading oil in euros to compensate for the US dollar's decline in value.

Another alternative is to trade in a basket of currencies other than the greenback, Silva told Venezuela's state news agency, Venpres.

"There is a talk of trading crude in euros. It is one of the alternatives," the former Venezuelan oil minister said from Vienna late on Monday.

"It is possible that the organisation will discuss that, and make a decision at some point in time," he said.

Silva did not provide more details.

At its meeting in Vienna last week, the Organisation of Petroleum Exporting Countries expressed concern that the US dollar's decline against the euro and yen was eroding its members' purchasing power.

Many OPEC members are Middle Eastern countries reliant on imports from western Europe and Japan.

OPEC decided last week to keep its target output ceiling stable at 24.5 million barrels a day. Saudi Oil Minister Ali Naimi said the decision was due in part to the weakening dollar.

The US dollar hit a new low against the euro on Monday, with the European common currency reaching USD 1.2276. The greenback is at a three-year low against the yen at 107.19 yen.

Will the war crush the U.S. dollar?

OPINION

By Robert Shapiro

SLATE.COM www.msnbc.com/news/891133.asp?0si=&cp1=1

March 26 — For months, the prospect, and now the reality, of war with Iraq have unnerved but not yet disrupted global currency markets. The odds are still small that the war will trigger a currency crisis. If it does, you’ll see it in a fast-falling dollar; and given our current sour relations with much of the G-7, we might not be able to do much about it.

IN THE INTERNATIONAL ECONOMY, more money is made or lost from currency movements—or at least, more money is made or lost faster—than any other way. Speculators such as hedge funds can sometimes make or lose a fortune overnight in currency bets, but the value of the dollar, the yen, and the euro are fundamentally driven by the normal transactions of the global economy. When a London bank buys U.S. Treasuries or shares in a U.S. company, or a Spanish firm buys computers from a U.S. maker, it has to use pounds or euros to buy dollars, so it can pay the American seller. The more demand for dollars to carry out the daily business of trade and investment, the more euros or pounds it takes to buy them.

The war has not been good for the dollar. Since last November, the greenback has fallen nearly 7 percent against a basket of other major currencies. First, Middle Eastern investors converted a lot of their dollar holdings and took them home: By the New Year, all the imponderables about the coming war left European and Asian investors reluctant to expand their U.S. holdings. The result has been less foreign investment in the United States, translating into less demand for dollars in world markets.

.... The war gave the dollar a shove, but it’s been sliding for more than a year—down almost 15 percent since early 2002.

.... The dollar’s decline in the last four months has reduced the dollar value of these holdings by $445 billion; its fall over the last year cost more than $950 billion.

A falling dollar is bad news for a lot of people because greenbacks are also the global economy’s principal medium of exchange. Foreign producers of oil and many other commodities, along with a goodly share of global manufacturing companies, prefer payment in dollars to Saudi riyals or South Korean wan. Foreign governments, or at least their finance ministries, also usually like a steady dollar, since dollars make up two-thirds of the reserves they hold to back up their own currencies. The 15 percent fall in the dollar has made a lot of people in a lot of places a little poorer.

Add local news and weather to the MSNBC home page. A weaker dollar, however, is good news for U.S. exporters because it makes their products cheaper in foreign markets. It also helps U.S. companies that compete with foreign imports, because a stronger euro or yen—the other side of the weaker dollar—makes imports more expensive in the United States.

The worst is probably yet to come, because the dollar’s decline reflects not only all the uncertainties about the war’s impact on U.S. growth, but also increasing concerns about a structural imbalance in the American and global economies. The core of the problem is that we don’t save enough. To keep spending and investing at the rates we have, we have to tap the savings of foreigners. The bookkeeping expression of this undersaving, or the amount we have to borrow, is the current account deficit—$503 billion last year.

Indonesia considers switch from dollar to euro Asia Times April 1, 2003

JAKARTA - Echoing a wider move away from the US dollar, the Indonesian government and the central bank, Bank Indonesia, may begin to use the euro in export-import transactions and foreign-exchange reserves.

The statement was made by Finance Minister Boediono, Bank Indonesia governor Syahril Sabirin and senior deputy governor Anwar Nasution here on the weekend in connection with state oil company Pertamina's plan to use the euro in its trade transactions.

"The US dollar is now still dominating trade. It is possible to use [the] euro when it replaces the dollar's position," the minister said.

Boediono said that if the US dollar continues to weaken compared with other foreign currencies including the euro, users of the greenback may seek more stable currencies.

(Asia Pulse/Antara) www.atimes.com/atimes/Southeast_Asia/ED01Ae04.html

The Euro And The War On Iraq

By Amir Butler

ATrueWord.com

info@atrueword.com

3-29-2003

As Mark Twain once noted, prophecy is always difficult, particularly with regards to the future. However, it is a safe bet that as soon as Saddam is toppled one of the first tasks of the America-backed regime will be to restore the US dollar as the nation's oil currency.

In November 2000, Iraq began selling its oil for euros, moving away from the post-World War II standard of the US dollar as the currency of international trade. Whilst seen by many at the time as a bizarre act of political defiance, it has proved beneficial for Iraq, with the euro gaining almost 25% against the dollar during 2001. It now costs around USD$1.05 to buy one Euro.

Iraq's move towards the euro is indicative of a growing trend. Iran has already converted the majority of its central bank reserve funds to the euro, and has hinted at adopting the euro for all oil sales. On December 7th, 2002, the third member of the axis of evil, North Korea, officially dropped the dollar and began using euros for trade. Venezuela, not a member of the axis of evil yet, but a large oil producer nonetheless, is also considering a switch to the euro. More importantly, at its April 14th, 2002 meeting in Spain, OPEC expressed an interest in leaving the dollar in favour of the euro.

If OPEC were to switch to the euro as the standard for oil transactions, it would have serious ramifications for the US economy. Oil-consuming economies would have to flush the dollars out of their central bank holdings and convert them to euros. Some economists estimate that with the market flooded, the US dollar could drop up to 40% in value. As the currency falls, there would be a monetary evacuation by foreign investors abandoning the US stock markets and dollar-denominated assets. Imported products would cost Americans a lot more, and the trade deficit would be magnified.

It is foreign demand for the US dollar that funds the US federal budget deficits. Foreign investors flush with dollars typically look to US treasury securities as a means of secure investment. With a large reduction in such investment, the country could potentially go into default. Things could turn very bad, very quickly.

In May 2004 an additional 10 member nations will join the European Union. At that point, the EU will represent an oil consumer 33% larger than the United States. In order to mitigate currency risks, the Europeans will increasingly pressure OPEC to trade in euros, and with the EU at that stage buying over half of OPEC oil production, such a change seems likely.

This is a scenario that America cannot afford to see eventuate. The US will go to any length to fend off an attempt by OPEC to dump greenbacks as its reserve currency. Attacking Iraq and installing a client regime in Baghdad may have a preventative effect. It will certainly ensure that Iraq returns to using dollars and provide a violent example to any other nation in the region contemplating a migration to the euro.

An American-backed junta in Iraq would also enable the US to smash OPEC's hold over oil prices. The US or its client regime could increase Iraqi oil production to levels well beyond OPEC quotas, driving prices down worldwide and weakening the economies of the oil producing nations, thus lessening their likelihood of abandoning the dollar. It would have the short term effect of reducing the profits of domestic oil companies, but the long term effect of securing America's economic hegemony.

The frequently offered canard of the Left that this war is being fought to secure oil revenues for American oil companies may have some truth to it. However, a more plausible explanation may be that the Bush administration is waging war to protect the dollar and smash the OPEC hold over international oil prices. It's a war whose purpose is bigger than Halliburton or Exxon: it's a war being fought to maintain America's position in the world.

Attending the 1992 Earth Summit in Rio, George Bush Senior told the world that, "the American way of life is not negotiable". As cruise missiles rain on Iraq, we are learning just how 'non-negotiable' that way of life really is.

Amir Butler is executive director of the Australian Muslim Public Affairs Committee (AMPAC), and writes for ATrueWord.com. He can be contacted at abutler@atrueword.com.

www.guardian.co.uk/Iraq/Story/0,2763,922217,00.html

Bush fiddles with economy while Baghdad burns, by Mark Tran

Wednesday March 26, 2003

Independent Strategy sees the weakening dollar as the fourth strand in the decline of empire.

"The dollar will go on down because the good empire has the same faultlines as many other empires: unsustainable living standards at the core depend on flows of wealth from the periphery," says Independent Strategy in terms that would not be out of a place in a Marxist textbook. "The US no longer earns the return needed to sustain these flows. The costs of war and unilateralism will increase the thirst for capital, but reduce the return earned by it."

In plain English, America relies on the rest of the world to finance its deficits. The rest of the world was happy to do so when the US economy was strong and returns were high, but investors will put their cash elsewhere if America looks weak economically. America borrows hundreds of millions of dollars from the rest of the world each day to cover its savings gap and, under George Bush, US dependence on foreign capital is set to increase.

The decline of empire thesis is not exactly new. Paul Kennedy, the British historian, wrote the best-selling The Rise and Fall of the Great Powers back in 1988, where he coined the phrase "imperial overstretch". It was a great read, but then the US embarked on a record-breaking expansion that lasted 10 years and saw Wall Street shoot up to over 11,000 points.

But that great economic expansion turned out not to be so great after all, culminating in a wave of financial misreporting and outright fraud at Enron and WorldCom. The twilight of empires can last a long time, but judging from his reckless unilateralism and his economic vandalism, George Bush seems to be determined to do his level best to hasten that decline.

When will we buy oil in euros?

Sunday February 23, 2003

The Observer www.observer.co.uk/business/story/0,6903,900867,00.html

Whether the price of oil is surging to new highs, as it is today, or slumping, as is predicted after a war in Iraq, there is one enduring constant.

Oil trading, whether from Norway to the Netherlands, Britain to Bermuda, or Bahrain to Bangladesh, operates through the US greenback.

The oil-dollar nexus is one of the foundations of the world economy that inevitably filters through to geopolitics. Recycling so-called petrodollars, the proceeds of these high oil prices, has helped the United States run its colossal trade deficits. But the past year has seen the quiet emergence of the 'petroeuro'.

Effectively, the normal standards of economics have not applied to the US, because of the international role of the dollar. Some $3 trillion (£1,880 billion) are in circulation around the world helping the US to run virtually permanent trade deficits. Two-thirds of world trade is dollar-denominated. Two-thirds of central banks' official foreign exchange reserves are also dollar-denominated.

Dollarisation of the oil markets is one of the key drivers for this, alongside, in recent years, the performance of the US economy. The majority of countries that require oil imports require dollars to pay for their fuel. Oil exporters similarly hold, as their currency reserve, billions in the currency in which they are paid. Investing these petrodollars straight back into the US economy is possible at zero currency risk.

So the US can carry on printing money - effectively IOUs - to fund tax cuts, increased military spending, and consumer spending on imports without fear of inflation or that these loans will be called in. As keeper of the global currency there is always the last-ditch resort to devaluation, which forces other countries' exporters to pay for US economic distress. It's probably the nearest thing to a 'free lunch' in global economics.

And for a long time, everything has worked smoothly. The oil industry was born in Texas, and so developed in dollars. The complex web of supply chains, distribution, and futures markets, all run off the central rock that is the US dollar.

But now there is the euro. At the time of its launch, various overblown claims were made to its role as 'co-hegemon', sharing the spoils of reserve currency status. The rapid fall in the euro after its launch put paid to such suggestions. But the single currency has since rescued itself, reigniting talk of euro-ised oil. In fact, it's happening already.

Iraqi oil, two-thirds of which is being snapped up by US companies, can only be paid for in euros.

'It was a political move on the part of the Iraqi government to show that the euro could be a substitute for the dollar in denominating the oil price,' says Fadhil Chalabi of the Centre for Global Energy Studies.

That move was made in the same week that the euro reached its historic low of $0.82 in October 2000. The subsequent 30 per cent rise in the euro has greatly helped the United Nations' oil-for-food programme in Iraq.

Soon afterwards, Jordan launched its own bilateral trade scheme with Iraq, carried out entirely in euros.

Last year, in a little noticed Opec speech to a Spanish Finance Ministry conference, Javad Yarjani, a senior Iranian oil diplomat, said: 'It is quite possible that as bilateral trade increases between the Middle East and the European Union, it could be feasible to price oil in euros. This would foster further ties between these trading blocs by increasing commercial exchange, and by helping attract much-needed European investment in the Middle East.'

Yarjani said the 'critical question is the overall value and stability of the euro, and whether other countries within the union adopt the single currency'.

The first point is beginning to be answered. The second refers to Britain and Norway. If either joins the single currency, the key Brent benchmark could be redenominated in euros, offering an impetus to movers within Opec.

The rising value of the euro makes redenomination in the immediate financial interest of European oil majors such as TotalFinaElf and Shell. Over the past year both companies have seen profits gobbled up by the dollar slump, as their profits are calculated in euros. Opec member countries too would have a strong interest in moving to euros. The eurozone is the biggest importer of oil in the world and 45 per cent of Middle East imports are from Europe. Even US oil majors would benefit from selling their oil in a currency that is increasing in value, say US energy consultants.

The Iranian and Russian parliaments have recently discussed adopting the euro for oil sales.

Last year Russia entered into negotiations with Germany over the establishment of an exchange to sell oil futures denominated in euros. Russia, which on some measures is the world's Number 1 oil producer at the moment, is awash with petrodollars, but trades mainly with Europe. Russia's foreign exchange holdings recently reached an all-time high of $50bn.

At the moment, European consumers are benefiting from the link between oil and the dollar. The euro's surge has, in effect, paid for much of the increase in the price of oil. This, however, is just the flipside of the very high prices in France and Germany in Autumn 2000, which were a combination of a very weak euro and high oil price. US consumers have no such additional worries, as there is no currency risk.

So there is a huge list of potential winners from a move to price oil in euros, but movement remains slow.

'At various points in time since the early 1970s, oil producers have discussed this, especially in periods when the dollar has been weak. Opinions have tended to be wide-ranging, depending on the strategic and trade alliances certain members have with particular trade blocs,' said Yarjani.

That was an elliptical reference to the overwhelming influence of Saudi Arabia, whose government is the staunchest ally of the US within Opec.

'The Saudis are holding the line on oil prices in Opec and should they, for example, go along with the rest of the Opec people in demanding that oil be priced in euros, that would deal a very heavy blow to the American economy,' Youssef Ibrahim, of the influential US Council on Foreign Relations, told CNN.

Last year the former US Ambassador to Saudi Arabia told a committee of the US Congress: 'One of the major things the Saudis have historically done, in part out of friendship with the United States, is to insist that oil continues to be priced in dollars. Therefore, the US Treasury can print money and buy oil, which is an advantage no other country has. With the emergence of other currencies and with strains in the relationship, I wonder whether there will not again be, as there have been in the past, people in Saudi Arabia who raise the question of why they should be so kind to the United States.'

Historically, empires have been exporters of capital, rather than importers like the US. The dollar has been vital to this revolution. At the euro's launch Martin Feldstein, a Harvard economist, pointed to the possibility that the single currency could weaken the status of the dollar to the extent that it 'could complicate international military relationships'. Feldstein is an outside contender to replace Alan Greenspan at the Federal Reserve.

Oil pricing is just the background to a wider issue. The Bank of China and the Russian Central Bank are both rumoured to be waiting for the best moment to increase the holdings of euros. Only 5 per cent of Chinese reserves are held in euros, but more than 20 per cent of its trade is with Europe. Middle Eastern states hold $700bn of US assets, but comparatively little in Europe.

So is the euro the missing link between the 'axis of evil' and the 'axis of weasel'? It is greatly appreciated in the former and was invented in the latter. Research by State Street shows that the euro has gained 'safe haven' status since last August as the dollar has lost it. It's likely this shift is a temporary phenomenon. Petroeuros may just change that.

www.GuluFuture.com/news/eurozone_war030323.htm

AILING DOLLAR STRIKES

AT EURO IN IRAQ WAR

23rd March, 2003 17:00 GMT

An Economic Perspective On The War

It's Not About Oil Or Iraq.

It's About The US And Europe Going

Head-To-Head On World Economic Dominance.

By Geoffrey Heard, Australia

Summary: Why is George Bush so hell bent on war with Iraq? Why does his administration reject every positive Iraqi move? It all makes sense when you consider the economic implications for the USA of not going to war with Iraq. The war in Iraq is actually the US and Europe going head to head on economic leadership of the world.

America's Bush administration has been caught in outright lies, gross exaggerations and incredible inaccuracies as it trotted out its litany of paper thin excuses for making war on Iraq. Along with its two supporters, Britain and Australia, it has shifted its ground and reversed its position with a barefaced contempt for its audience. It has manipulated information, deceived by commission and omission and frantically "bought" UN votes with billion dollar bribes.

Faced with the failure of gaining UN Security Council support for invading Iraq, the USA has threatened to invade without authorisation. It would act in breach of the UN's very constitution to allegedly enforced UN resolutions.

It is plain bizarre. Where does this desperation for war come from?

There are many things driving President Bush and his administration to invade Iraq, unseat Saddam Hussein and take over the country. But the biggest one is hidden and very, very simple. It is about the currency used to trade oil and consequently, who will dominate the world economically, in the foreseeable future -- the USA or the European Union.

Iraq is a European Union beachhead in that confrontation. America had a monopoly on the oil trade, with the US dollar being the fiat currency, but Iraq broke ranks in 1999, started to trade oil in the EU's euros, and profited. If America invades Iraq and takes over, it will hurl the EU and its euro back into the sea and make America's position as the dominant economic power in the world all but impregnable.

It is the biggest grab for world power in modern times.

America's allies in the invasion, Britain and Australia, are betting America will win and that they will get some trickle-down benefits for jumping on to the US bandwagon.

France and Germany are the spearhead of the European force -- Russia would like to go European but possibly can still be bought off.

Presumably, China would like to see the Europeans build a share of international trade currency ownership at this point while it continues to grow its international trading presence to the point where it, too, can share the leadership rewards.

DEBATE BUILDING ON THE INTERNET

Oddly, little or nothing is appearing in the general media about this issue, although key people are becoming aware of it -- note the recent slide in the value of the US dollar. Are traders afraid of war? They are more likely to be afraid there will not be war.

But despite the silence in the general media, a major world discussion is developing around this issue, particularly on the internet. Among the many articles: Henry Liu, in the 'Asia Times' last June, it has been a hot topic on the Feasta forum, an Irish-based group exploring sustainable economics, and W. Clark's "The Real Reasons for the Upcoming War with Iraq: A Macroeconomic and Geostrategic Analysis of the Unspoken Truth" has been published by the 'Sierra Times', 'Indymedia.org', and 'ratical.org'.

This debate is not about whether America would suffer from losing the US dollar monopoly on oil trading -- that is a given -- rather it is about exactly how hard the USA would be hit. The smart money seems to be saying the impact would be in the range from severe to catastrophic. The USA could collapse economically.

OIL DOLLARS

The key to it all is the fiat currency for trading oil.

Under an OPEC agreement, all oil has been traded in US dollars since 1971 (after the dropping of the gold standard) which makes the US dollar the de facto major international trading currency. If other nations have to hoard dollars to buy oil, then they want to use that hoard for other trading too. This fact gives America a huge trading advantage and helps make it the dominant economy in the world.

As an economic bloc, the European Union is the only challenger to the USA's economic position, and it created the euro to challenge the dollar in international markets. However, the EU is not yet united behind the euro -- there is a lot of jingoistic national politics involved, not least in Britain -- and in any case, so long as nations throughout the world must hoard dollars to buy oil, the euro can make only very limited inroads into the dollar's dominance.

In 1999, Iraq, with the world's second largest oil reserves, switched to trading its oil in euros. American analysts fell about laughing; Iraq had just made a mistake that was going to beggar the nation. But two years on, alarm bells were sounding; the euro was rising against the dollar, Iraq had given itself a huge economic free kick by switching.

Iran started thinking about switching too; Venezuela, the 4th largest oil producer, began looking at it and has been cutting out the dollar by bartering oil with several nations including America's bete noir, Cuba. Russia is seeking to ramp up oil production with Europe (trading in euros) an obvious market.

The greenback's grip on oil trading and consequently on world trade in general, was under serious threat. If America did not stamp on this immediately, this economic brushfire could rapidly be fanned into a wildfire capable of consuming the US's economy and its dominance of world trade.

HOW DOES THE US

GET ITS DOLLAR ADVANTAGE?

Imagine this: you are deep in debt but every day you write cheques for millions of dollars you don't have -- another luxury car, a holiday home at the beach, the world trip of a lifetime.

Your cheques should be worthless but they keep buying stuff because those cheques you write never reach the bank! You have an agreement with the owners of one thing everyone wants, call it petrol/gas, that they will accept only your cheques as payment. This means everyone must hoard your cheques so they can buy petrol/gas. Since they have to keep a stock of your cheques, they use them to buy other stuff too. You write a cheque to buy a TV, the TV shop owner swaps your cheque for petrol/gas, that seller buys some vegetables at the fruit shop, the fruiterer passes it on to buy bread, the baker buys some flour with it, and on it goes, round and round -- but never back to the bank.

You have a debt on your books, but so long as your cheque never reaches the bank, you don't have to pay. In effect, you have received your TV free.

This is the position the USA has enjoyed for 30 years -- it has been getting a free world trade ride for all that time. It has been receiving a huge subsidy from everyone else in the world. As it debt has been growing, it has printed more money (written more cheques) to keep trading. No wonder it is an economic powerhouse!

Then one day, one petrol seller says he is going to accept another person's cheques, a couple of others think that might be a good idea. If this spreads, people are going to stop hoarding your cheques and they will come flying home to the bank. Since you don't have enough in the bank to cover all the cheques, very nasty stuff is going to hit the fan!

But you are big, tough and very aggressive. You don't scare the other guy who can write cheques, he's pretty big too, but given a 'legitimate' excuse, you can beat the tripes out of the lone gas seller and scare him and his mates into submission.

And that, in a nutshell, is what the USA is doing right now with Iraq.

AMERICA'S PRECARIOUS

ECONOMIC POSITION

America is so eager to attack Iraq now because of the speed with which the euro fire could spread. If Iran, Venezuela and Russia join Iraq and sell large quantities of oil for euros, the euro would have the leverage it needs to become a powerful force in general international trade. Other nations would have to start swapping some of their dollars for euros.

The dollars the USA has printed, the 'cheques' it has written, would start to fly home, stripping away the illusion of value behind them. The USA's real economic condition is about as bad as it could be; it is the most debt-ridden nation on earth, owing about US$12,000 for every single one of it's 280 million men, women and children. It is worse than the position of Indonesia when it imploded economically a few years ago, or more recently, that of Argentina.

Even if OPEC did not switch to euros wholesale (and that would make a very nice non-oil profit for the OPEC countries, including minimising the various contrived debts America has forced on some of them), the US's difficulties would build. Even if only a small part of the oil trade went euro, that would do two things immediately:

* Increase the attractiveness to EU members of joining the 'eurozone', which in turn would make the euro stronger and make it more attractive to oil nations as a trading currency and to other nations as a general trading currency.

* Start the US dollars flying home demanding value when there isn't enough in the bank to cover them.

* The markets would over-react as usual and in no time, the US dollar's value would be spiralling down.

THE US SOLUTION

America's response to the euro threat was predictable. It has come out fighting.

It aims to achieve four primary things by going to war with Iraq:

* Safeguard the American economy by returning Iraq to trading oil in US dollars, so the greenback is once again the exclusive oil currency.

* Send a very clear message to any other oil producers just what will happen to them if they do not stay in the dollar circle. Iran has already received one message -- remember how puzzled you were that in the midst of moderation and secularization, Iran was named as a member of the axis of evil?

* Place the second largest reserves of oil in the world under direct American control.

* Provide a secular, subject state where the US can maintain a huge force (perhaps with nominal elements from allies such as Britain and Australia) to dominate the Middle East and its vital oil. This would enable the US to avoid using what it sees as the unreliable Turkey, the politically impossible Israel and surely the next state in its sights, Saudi Arabia, the birthplace of al Qaeda and a hotbed of anti-American sentiment.

* Severe setback the European Union and its euro, the only trading bloc and currency strong enough to attack the USA's dominance of world trade through the dollar.

* Provide cover for the US to run a covert operation to overturn the democratically elected government of Venezuela and replace it with an America-friendly military supported junta -- and put Venezuala's oil into American hands.

Locking the world back into dollar oil trading would consolidate America's current position and make it all but impregnable as the dominant world power -- economically and militarily. A splintered Europe (the US is working hard to split Europe; Britain was easy, but other Europeans have offered support in terms of UN votes) and its euro would suffer a serious setback and might take decades to recover.

It is the boldest grab for absolute power the world has seen in modern times. America is hardly likely to allow the possible slaughter of a few hundred thousand Iraqis stand between it and world domination.

President Bush did promise to protect the American way of life. This is what he meant.

JUSTIFYING WAR

Obviously, the US could not simply invade Iraq, so it began casting around for a 'legitimate' reason to attack. That search has been one of increasing desperation as each rationalization has crumbled. First Iraq was a threat because of alleged links to al Qaeda; then it was proposed Iraq might supply al Qaeda with weapons; then Iraq's military threat to its neighbours was raised; then the need to deliver Iraqis from Saddam Hussein's horrendously inhumane rule; finally there is the question of compliance with UN weapons inspection.

The USA's justifications for invading Iraq are looking less impressive by the day. The US's statements that it would invade Iraq unilaterally without UN support and in defiance of the UN make a total nonsense of any American claim that it is concerned about the world body's strength and standing.

The UN weapons inspectors have come up with minimal infringements of the UN weapons limitations -- the final one being low tech rockets which exceed the range allowed by about 20 percent. But there is no sign of the so-called weapons of mass destruction (WMD) the US has so confidently asserted are to be found. Colin Powell named a certain north Iraqi village as a threat. It was not. He later admitted it was the wrong village.

'Newsweek' (24/2) has reported that while Bush officials have been trumpeting the fact that key Iraqi defector, Lt. Gen. Hussein Kamel, told the US in 1995 that Iraq had manufactured tonnes of nerve gas and anthrax (Colin Powell's 5 February presentation to the UN was just one example) they neglected to mention that Kamel had also told the US that these weapons had been destroyed.

Parts of the US and particularly the British secret 'evidence' have been shown to come from a student's masters thesis.

America's expressed concern about the Iraqi people's human rights and the country's lack of democracy are simply not supported by the USA's history of intervention in other states nor by its current actions. Think Guatemala, the Congo, Chile and Nicaragua as examples of a much larger pool of US actions to tear down legitimate, democratically elected governments and replace them with war, disruption, starvation, poverty, corruption, dictatorships, torture, rape and murder for its own economic ends. The most recent, Afghanistan, is not looking good; in fact that reinstalled a murderous group of warlords which America had earlier installed, then deposed, in favour of the now hated Taliban.

Saddam Hussein was just as repressive, corrupt and murderous 15 years ago when he used chemical weapons, supplied by the US, against the Kurds. The current US Secretary for Defence, Donald Rumsfeld, so vehement against Iraq now, was on hand personally to turn aside condemnation of Iraq and blame Iran. At that time, of course, the US thought Saddam Hussein was their man -- they were using him against the perceived threat of Iran's Islamic fundamentalism.

Right now, as 'The Independent' writer, Robert Fisk, has noted, the US's efforts to buy Algeria's UN vote includes promises of re-arming the military which has a decade long history of repression, torture, rape and murder Saddam Hussein himself would envy. It is estimated 200,000 people have died, and countless others been left maimed by the activities of these monsters. What price the US's humanitarian concerns for Iraqis? (Of course, the French are also wooing Algeria, their former north African territory, for all they are worth, but at least they are not pretending to be driven by humanitarian concerns.)

Indonesia is another nation with a vote and influence as the largest Muslim nation in the world. Its repressive, murderous military is regaining strength on the back of the US's so-called anti-terror campaign and is receiving promises of open and covert support -- including intelligence sharing.

AND VENEZUELA

While the world's attention is focused on Iraq, America is both openly and covertly supporting the "coup of the rich" in Venezuela, which grabbed power briefly in April last year before being intimidated by massive public displays of support by the poor for democratically-elected President Chavez Frias. The coup leaders continue to use their control of the private media, much of industry and the ear of the American Government and its oily intimates to cause disruption and disturbance.

Venezuela's state-owned oil resources would make rich pickings for American oil companies and provide the US with an important oil source in its own backyard.

Many writers have noted the contradiction between America's alleged desire to establish democracy in Iraq while at the same time, actively undermining the democratically-elected government in Venezuela. Above the line, America rushed to recognise the coup last April; more recently, President Bush has called for "early elections", ignoring the fact that President Chavez Frias has won three elections and two referendums and, in any case, early elections would be unconstitutional.

One element of the USA's covert action against Venezuela is the behaviour of American transnational businesses, which have locked out employees in support of "national strike" action. Imagine them doing that in the USA! There is no question that a covert operation is in process to overturn the legitimate Venezuelan government. Uruguayan congressman, Jose Nayardi, made it public when he revealed that the Bush administration had asked for Uruguay's support for Venezuelan white collar executives and trade union activists "to break down levels of intransigence within the Chavez Frias administration". The process, he noted, was a shocking reminder of the CIA's 1973 intervention in Chile which saw General Pinochet lead his military coup to take over President Allende's democratically elected government in a bloodbath.

President Chavez Frias is desperately clinging to government, but with the might of the USA aligned with his opponents, how long can he last?

THE COST OF WAR

Some have claimed that an American invasion of Iraq would cost so many billions of dollars that oil returns would never justify such an action.

But when the invasion is placed in the context of the protection of the entire US economy for now and into the future, the balance of the argument changes.

Further, there are three other vital factors:

First, America will be asking others to help pay for the war because it is protecting their interests. Japan and Saudi Arabia made serious contributions to the cost of the 1991 Gulf war.

Second -- in reality, war will cost the USA very little -- or at least, very little over and above normal expenditure. This war is already paid for! All the munitions and equipment have been bought and paid for. The USA would have to spend hardly a cent on new hardware to prosecute this war -- the expenditure will come later when munitions and equipment have to be replaced after the war. But amunitions, hardware and so on are being replaced all the time -- contracts are out. Some contracts will simply be brought forward and some others will be ramped up a bit, but spread over a few years, the cost will not be great. And what is the real extra cost of an army at war compared with maintaining the standing army around the world, running exercises and so on? It is there, but it is a relatively small sum.

Third -- lots of the extra costs involved in the war are dollars spent outside America, not least in the purchase of fuel. Guess how America will pay for these? By printing dollars it is going to war to protect. The same happens when production begins to replace hardware components, minerals, etc. are bought in with dollars that go overseas and exploit America's trading advantage.

The cost of war is not nearly as big as it is made out to be. The cost of not going to war would be horrendous for the USA -- unless there were another way of protecting the greenback's world trade dominance.

AMERICA'S TWO ACTIVE ALLIES

Why are Australia and Britain supporting America in its transparent Iraqi war ploy?

Australia, of course, has significant US dollar reserves and trades widely in dollars and extensively with America. A fall in the US dollar would reduce Australia's debt, perhaps, but would do nothing for the Australian dollar's value against other currencies. John Howard, the Prime Minister, has long cherished the dream of a free trade agreement with the USA in the hope that Australia can jump on the back of the free ride America gets in trade through the dollar's position as the major trading medium. That would look much less attractive if the euro took over a significant part of the oil trade.

Britain has yet to adopt the euro. If the US takes over Iraq and blocks the euro's incursion into oil trading, Tony Blair will have given his French and German counterparts a bloody nose, and gained more room to manouevre on the issue -- perhaps years more room.

Britain would be in a position to demand a better deal from its EU partners for entering the "eurozone" if the new currency could not make the huge value gains guaranteed by a significant role in world oil trading. It might even be in a position to withdraw from Europe and link with America against continental Europe.

On the other hand, if the US cannot maintain the oil trade dollar monopoly, the euro will rapidly go from strength to strength, and Britain could be left begging to be allowed into the club.

THE OPPOSITION

Some of the reasons for opposition to the American plan are obvious -- America is already the strongest nation on earth and dominates world trade through its dollar. If it had control of the Iraqi oil and a base for its forces in the Middle East, it would not add to, but would multiply its power.

The oil-producing nations, particularly the Arab ones, can see the writing on the wall and are quaking in their boots.

France and Germany are the EU leaders with the vision of a resurgent, united Europe taking its rightful place in the world and using its euro currency as a world trading reserve currency and thus gaining some of the free ride the United States enjoys now. They are the ones who initiated the euro oil trade with Iraq.

Russia is in deep economic trouble and knows it will get worse the day America starts exploiting its take-over of Afghanistan by running a pipeline southwards via Afghanistan from the giant southern Caspian oil fields. Currently, that oil is piped northwards -- where Russia has control.

Russia is in the process of ramping up oil production with the possibility of trading some of it for euros and selling some to the US itself. Russia already has enough problems with the fact that oil is traded in US dollars; if the US has control of Iraqi oil, it could distort the market to Russia's enormous disadvantage. In addition, Russia has interests in Iraqi oil; an American take over could see them lost. Already on its knees, Russia could be beggared before a mile of the Afghanistan pipeline is laid.

ANOTHER SOLUTION?

The scenario clarifies the seriousness of America's position and explains its frantic drive for war. It also suggests that solutions other than war are possible.

Could America agree to share the trading goodies by allowing Europe to have a negotiated part of it? Not very likely, but it is just possible Europe can stare down the USA and force such an outcome. Time will tell. What about Europe taking the statesmanlike, humanitarian and long view, and withdrawing, leaving the oil to the US, with appropriate safeguards for ordinary Iraqis and democracy in Venezuela?

Europe might then be forced to adopt a smarter approach -- perhaps accelerating the development of alternative energy technologies which would reduce the EU's reliance on oil for energy and produce goods it could trade for euros -- shifting the world trade balance.

Now that would be a very positive outcome for everyone.Geoffrey Heard is a Melbourne, Australia,

writer on the environment, sustainability and human rights.

Copyright Geoffrey Heard, 2003. Anyone is free to circulate this document provided it is complete and in its current form with attribution and no payment is asked. It is prohibited to reproduce this document or any part of it for commercial gain without the prior permission of the author.

Colin Nunan: Oil, Currency and the War on Iraq

It will not come as news to anyone that the US dominates the world economically and militarily. But the exact mechanisms by which American hegemony has been established and maintained are perhaps less well understood than they might be. One tool used to great effect has been the dollar, but its efficacy has recently been under threat since Europe introduced the euro.

The dollar is the de facto world reserve currency: the US currency accounts for approximately two thirds of all official exchange reserves. More than four-fifths of all foreign exchange transactions and half of all world exports are denominated in dollars. In addition, all IMF loans are denominated in dollars.

But the more dollars there are circulating outside the US, or invested by foreign owners in American assets, the more the rest of the world has had to provide the US with goods and services in exchange for these dollars. The dollars cost the US next to nothing to produce, so the fact that the world uses the currency in this way means that the US is importing vast quantities of goods and services virtually for free.

Since so many foreign-owned dollars are not spent on American goods and services, the US is able to run a huge trade deficit year after year without apparently any major economic consequences. The most recently published figures, for example, show that in November of last year US imports were worth 48% more than US exports. No other country can run such a large trade deficit with impunity. The financial media tell us the US is acting as the 'consumer of last resort' and the implication is that we should be thankful, but a more enlightening description of this state of affairs would be to say that it is getting a massive interest-free loan from the rest of the world.

While the US' position may seem inviolable, one should remember that the more you have, the more you have to lose. And recently there have been signs of how, for the first time in a long time, the US may be beginning to lose.

One of the stated economic objectives, and perhaps the primary objective, when setting up the euro was to turn it into a reserve currency to challenge the dollar so that Europe too could get something for nothing.