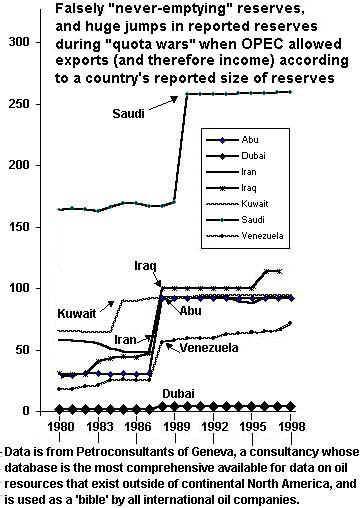

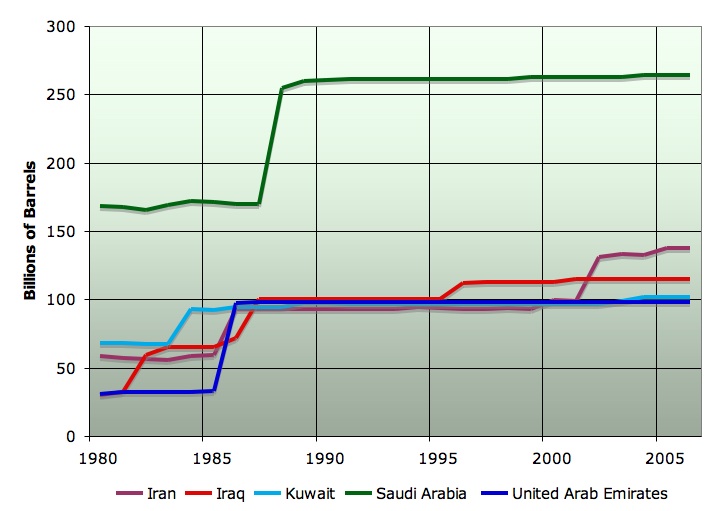

OPEC Quota Wars in 1980s

OPEC Quota Wars in 1980s

some of the reserves probably do not exist

OPEC quota war in 1980s

Unreliable oil reserves estimates

Almost no oil reserve estimates anywhere on Earth are reliable.

In the mid 1980s, the MidEast countries increased their estimates by double, part of a quota war that allowed export quotas based on proven reserves. No new oil fields were discovered to justify these increased figures.

So how much oil does the Middle East really have? It’s a secret.

graphic from theoildrum.com

www.asponews.org/ASPO.newsletter.018.php

Middle East production constraints

Matt Simmons reports

Today's Oil Daily had a very interesting story on the oil production woes of Kuwait which has been forced to rely overly on the output from Burgan, the world's number two producing oilfield. Kuwait has been forced to close three of its four crude centers over the past few weeks in the western part of the country, cutting production there by 243,000 b/d. The shut-ins resulted from a variety of bad problems, including toxic fumes, a collapsed line, a gas plant needing a redesign and routine maintenance, etc. This all highlights how old the major oil producing centers of the Middle East really are. We all know this, but most of the world still thinks Middle East oil is almost free.

According to the story, Burgan is now producing 1.35 Mb/d of its assumed 1.8 Mb/d output capacity. Everyone should remember that Burgan was discovered in 1938. As young kids in America often say, "it is no spring chicken!!" The cost of merely maintaining flat production in the Middle East is now on the rise. The days of cheap Middle East oil are a distant memory. Most people have not a clue about all this.

Based on discussion with a key Middle East expert at the Uppsala Workshop, it transpires that some of the national Middle East oil companies are managed by ageing executives who are reluctant to retire. They have little understanding of their reservoirs or the status of depletion, having been brought up in an age of plenty. It may be not so much that valid information on Middle East reserves is difficult to access, but rather that does not actually exist. Possibly, the OPEC secretariat is planning its strategy on information no more reliable than that in the BP Statistical Review of World Energy, which draws on the Oil & Gas Journal. It in turn relies on a questionnaire sent to foreign governments to which many do not reply, leaving the reserve reports implausibly unchanged, sometimes for years on end.

We have long suspected that Middle East reserves are greatly exaggerated. It begins to look as if we were right. Even if the reserves in the ground are there, the management and political environment suggests that these countries will have great difficulty in offsetting the natural decline of their ageing fields. It is not just a case of opening the valve, but calls for a great deal of skilled and careful reservoir management, nowhere more so than in Iran with its sensitive fields prone to gas coning.

www.davidstrahan.com/blog/?p=67

OIL HAS PEAKED, PRICES TO SOAR - SADAD AL-HUSEINI

Posted on Monday, October 29th, 2007

(Podcast) Sadad al-Huseini says that global production has reached its maximum sustainable plateau and that output will start to fall within 15 years, by which time the world’s oil resources will be “very severely depleted”.

In an exclusive interview with lastoilshock.com, the former head of exploration and production at Saudi Aramco, said that oil production had reached a structural ceiling determined by geology rather than geopolitics, and that the technical floor for the oil price will rise by $12 annually for the next 4 to 5 years as new fields become increasingly costly to exploit.

According to al-Huseini the technical floor - the basic cost of producing oil excluding factors such as geopolitical risk and hedge fund speculation - is currently about $70 per barrel, meaning the minimum oil price could hit $106 in 2010 and $130 by 2012. Actual crude prices, including financial market factors, could be be as much as $125 by as early as 2010.

Al-Huseini said that Saudi Arabia’s plans to raise production capacity to 12 million barrels per day by 2012 represented “an achievable number”, as the country had announced oil investments of $55 billion between 2003 and 2011. But he cautioned that since some of the new production will come from entirely new fields “how the reservoirs will respond will be determined as they start producing”.

However, al-Huseini disparaged Western expectations that the Kingdom would produce significantly more than 12 mb/d. It was unfair, he said, to expect Saudi to “pull everybody’s chestnuts out of the fire”.

Listen to the interview with Sadad al-Huseini.